.jpg)

Typical Structures of a Captive Insurance Program

For many lines of coverage, structuring the captive insurance policies is relatively straightforward. The captive insurance actuary or underwriter determines an appropriate premium for the risk, the insured pays the premium to the captive insurance company and a policy is issued. Other lines of coverage require coordination with traditional carriers or reinsurers. The illustrations below demonstrate several common structures captive insurance company owners may utilize when implementing their program.

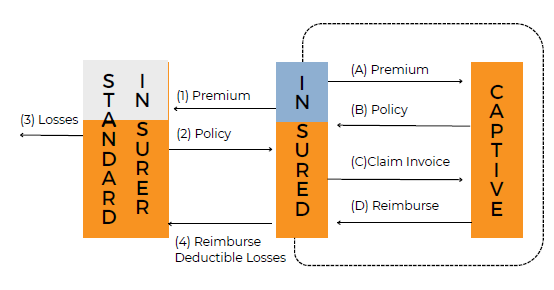

Deductible Buyback Captive Insurance Program

With a deductible buyback program, the insurance policy is a direct placement between an insured and the captive insurance company. The insured purchases a high-deductible policy from a commercial carrier. The insured is legally obligated for losses paid within the deductible. The insured then obtains a reimbursement policy from the captive insurance company. The captive insurance company is then obligated to reimburse the insured for losses incurred under the deductible.

Benefits:

- Potentially less frictional costs compared to a fronted captive insurance arrangement.

- Current insurer, broker, and claims administrator relationships remain undisturbed.

- Not necessary to disclose captive insurance to traditional insurers, or customers.

- Able to cap the captive insurance company’s risk equal to the standard deductible program maximum retention.

- Typical structure utilized for funding casualty retention through a single parent or pure captive insurance company.

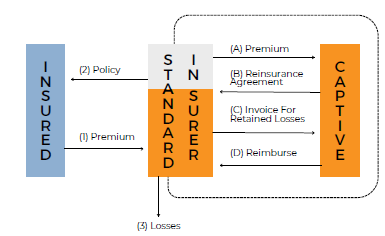

Fronted Captive Insurance Program

With a fronted program, the insurance policy is issued to the insured by an admitted “fronting” carrier. That carrier then reinsures all or a portion of the risk to the captive insurance company.

This provides the insured the ability realize underwriting profit while still having admitted, “A” rated coverage thru the policy issued by the front.

Benefits:

- Compliance: Many states require companies to provide evidence that an admitted insurer covers them for things like workers’ compensation insurance and auto liability. A captive insurer can comply with these requirements by using a fronting carrier.

- Financial strength: Fronting carriers typically have a high financial strength rating and/or admitted status that will comply with lenders', clients and vendors’ insurance requirements.

- Access to reinsurance: Sometimes, a captive insurer can serve as the fronting company and issue a policy directly to the insured parent company. The risk is then fully reinsured to one or more domestic or foreign reinsurers, and the fronting captive insurance company does not retain any of the risks. This can provide the parent company with access to the reinsurance market.

Navigating Captive Insurance Structures for Optimal Risk Management

Captive insurance companies offer businesses a flexible and potentially cost-effective approach to risk management. As we've explored, these entities can be structured in various ways to meet specific needs and regulatory requirements. The deductible buyback and fronted captive insurance programs represent two common approaches, each with its own benefits and considerations.

The deductible buyback program provides a streamlined solution for businesses seeking to retain control over risk management while potentially reducing frictional costs. On the other hand, the fronted captive insurance program offers advantages in compliance, financial strength ratings, and access to reinsurance markets.

Implementing a captive insurance program requires careful planning, actuarial analysis, and ongoing management regardless of the chosen structure. Businesses must work with experienced professionals to ensure their captive insurance company is properly structured, compliant with regulations, and optimized for tax efficiency.

By understanding these different structures and their implications, businesses can make informed decisions about leveraging captive insurance to protect their assets, manage risks, and potentially realize financial benefits. As the risk landscape evolves, captive insurance remains a powerful tool for sophisticated companies seeking to take control of their insurance programs and long-term risk management strategies.